CreditSights Euro Investment Grade & High Yield 2023 Credit Market Outlook

CreditSights / 12 January, 2023

Euro IG & HY 2023 Outlook: Hard Knock Life

- With our 2023 Euro IG & HY outlook we are recommending investors take a balanced view of Euro IG and HY with Market Weight/neutral allocations to each asset class. Wider spreads, especially in the IG market, are balanced by a more challenging fundamental outlook in both the Eurozone and the United Kingdom.

- Inflation may remain elevated in the Eurozone, forcing the ECB to surprise the market with greater than currently anticipated rate hikes. When combined with the potential announcement and launch of a quantitative tightening program, we see a less compelling case for spread tightening over the course of2023.

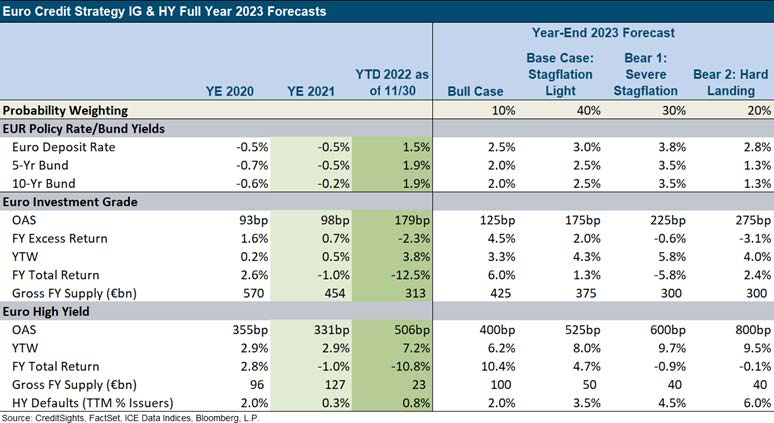

- With this in mind, our base case forecast for IG spreads is 175 bp, effectively a sideways move from current levels, with the potential for elevated volatility around central bank policy actions early in the year and energy-related challenges heading into winter 2023/2024. Our base case for HY spreads is 525bp, a move modestly wider from current levels as we expect lower rated issuers to face even more pressure from tighter financial conditions, rising defaults and less access to capital markets. Our base case total return forecast is 1%-2% for IG and 4%-5% for HY, while we expect IG excess returns of ~2.0%.

- In the Eurozone, we view the risks as significantly skewed to the downside and identified two potential bear scenarios: 1) prolonged stagflation as policymakers are unable to manage supply-driven inflation, or 2) a hard economic landing driven by an overtightening of monetary policy.

Relative Value

Key expectations and forecasts for 2023 include:

- Macroeconomic

- In the Eurozone, we expect a relatively shallow recession with 'stagflation-light' characteristics as real GDP' growth' slows to a -0.5% to +0.5% run rate. Inflation is more likely to remain elevated (when compared with the US) and could face another round of energy-driven pressure in 2H23.

- In the United Kingdom, we also expect a 'stagflation-light' economic scenario to emerge as inflation remains elevated and the economy slows even more than in the Eurozone to a -1.0% to 0.0% run rate. Inflation is set to remain quite high, with policy tightening only starting to show signs of material progress on the quest to sustainably lower inflation in 2H23. Property markets are likely to remain under pressure given continued policy tightening, rising mortgage rates and cost of living pressures.

- Monetary Policy/Sovereign Yields

- European Central Bank: ECB to hike 50 bp in December 2022 and February 2023, then downshifting to 25bp hikes in March and May 2023. We anticipate a terminal policy rate target of 3.0% and that the ECB remains on hold through the end of 2023 as it attempts to contain inflation. Preliminary details around quantitative tightening are expected at the December meeting. Given the uncertainty in the Eurozone and preference to complete policy normalization ahead of QT, we anticipate a 2Q23 commencement and a gradual phase in.

- Bank of England: We expect the BoE to hike 50 bp in December and February, before downshifting to 25bp at its March meeting. We expect the BoE to remain on hold from there at a terminal rate of 4.25%. We think Gilt sales are likely to remain in place at least through the first half of 2023, but the BoE could halt sales depending on the severity of the likely recession the economy is facing in 2023.

- Base Case Credit Spreads and Returns

- We anticipate a 'stagflation light' outcome as our base case for the Euro IG & HY markets.

- We expect a 'sideways' move in IG spreads, with bouts of central bank policy driven volatility, but ultimately do not expect to retest recent wides (226 bp).

- For HY, we look for spreads to end 2023 modestly wider at 525 bp, as lower rated issuers face liquidity challenges and defaults rise to 3.5% by year-end (US and Euro HY Default Rates: October 2022).

- Investment Themes for 2023: Hard Knock Life

- Euro Investment Grade

- We have a Market Weight Allocation to Euro IG as relatively short duration limits downside even amid rising yields while central bank and economic headwinds will continue to weigh on spreads.

- Curve Positioning: In both Fins and Corporates, the belly (3-5 year segment) offers the most attractive spread pick-up relative to historic levels. Long-end spread and yield curves are quite inverted, limiting our appetite for material duration extension.

- Ratings: We see good value in higher rated segments, including As and AAs which offer attractive spread pick-up versus lower rated cohorts. BBB valuations are not particularly compelling, leaving us biased to recommend reaching down to BBs for investors that are more comfortable taking on credit risk.

- Euro High Yield

- We have a Market Weight Allocation to Euro HY as current valuations off er balanced entry points for higher quality/defensive sectors. The HY market's high concentration of BB-rated issuers helps buffer fundamental deterioration from economic headwinds. Even so, a mix of relatively wide spreads, elevated yields and discounted prices limits downside even if spreads grind wider, as in our base case.

- Ratings: We prefer an up-in-quality ratings strategy with a focus on non-Financial, BB-rated corporates. Spread and yield curves are historically steep between BBs and BBBs. We are more cautious on stressed B sand CCCs as we anticipate more challenging liquidity conditions.

Full article available to GICP members and CreditSights subscribers.