Explore bank ratings criteria essentials

Bank ratings are assessments provided by credit rating agencies to evaluate the creditworthiness and financial stability of banking institutions. These ratings are crucial for investors, regulators, and the banks themselves as they offer insights into the risk level and operational health of the bank.

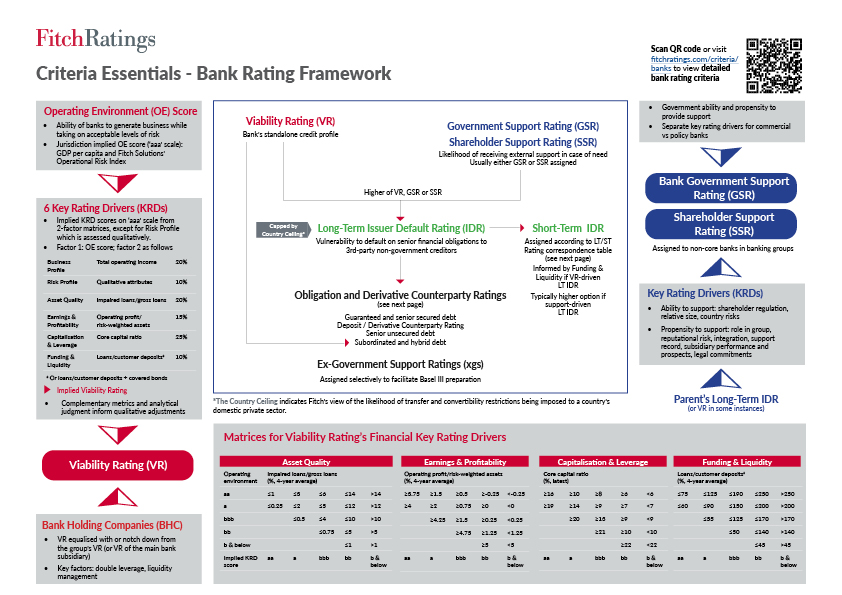

The framework used by Fitch Ratings to evaluate banks includes:

- Viability rating (VR): Reflects the intrinsic credit worthiness of a bank.

- Government support rating (GSR) or shareholder support rating (SSR): Reflects the likelihood of receiving extraordinary government or shareholder support to prevent the bank defaulting on senior obligations.

- Issuer default rating (IDR): Incorporates analysis of the banks credit worthiness and potential support. It reflects a banks vulnerability to default on senior obligations to third party, non- government creditors.

Fitch Ratings’ series of bite-sized videos provides further information on the ratings framework and related criteria for banks

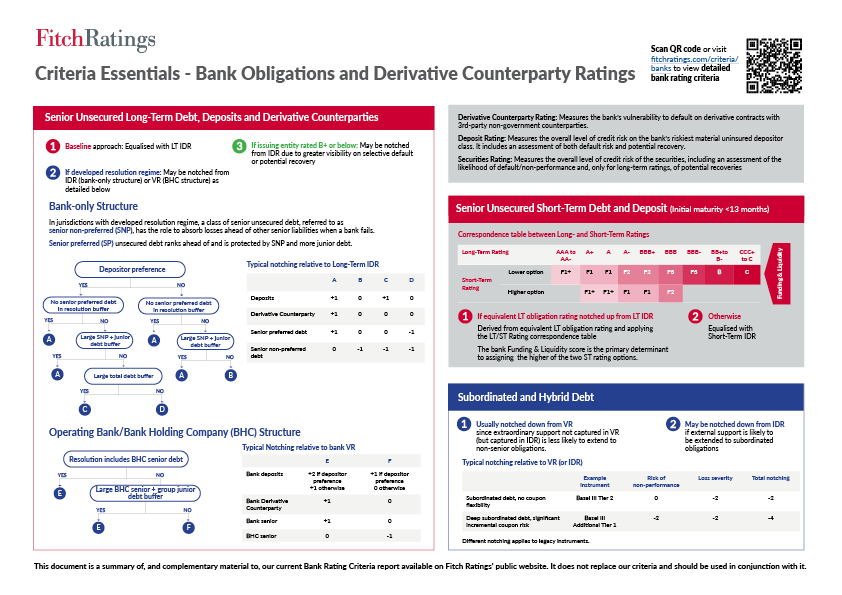

The following infographics offer a summary of how Fitch Ratings assigns ratings to banks.

Upcoming events

Info Session

Info Session

Info session: Excellence in credit analysis through the Global Credit Certificate

David Wong, Elena Pellegrini, John Wilton

10 March 2026

9:30 am to 10:15 am GMT

2:00 pm to 2:45 am EDT

Conference

Conference GICP Annual Conference 2026: Private Credit

Andreas Karaiskos, Adam Ahmed, Michael Berns and more

25 March 2026

1:30 pm to 6:00 pm GMT