Global relative value

The ‘Global Rel Val: Frameworks and Considerations’ article from CreditSights provides an overview of a framework for evaluating the relative attractiveness of investment-grade (IG) corporate bond markets globally. You can read the full article here. A CreditSights account may be required to access the article.

Relative value is crucial for credit analysts as it helps in evaluating the attractiveness of different investment opportunities within the global capital markets. By comparing bond valuations across various regions, analysts can determine whether a bond is fairly priced relative to others, which is essential for making informed investment decisions.

FX hedging

Hedging currency risk reduces the uncertainty of all-in returns over a given period by locking in the FX component.

Generally, FX forward contracts are the most commonly used approach to hedging currency risk. This is an agreement to exchange two currencies at a predetermined price at some point in the future. Typically, the FX forward transaction is quoted in forward points (or pips) which are applied to the spot rate to arrive at the forward contract price. Whether a currency trades at a forward premium or discount primarily depends on the interest rate differential of the two currencies.

For investors in geographies with relatively high interest rates, investing in assets in other countries and using FX forwards could enhance the yield on their investments. For example, for most Asian local currency (LCY) based investors, USTs and USD $ credits provide a decent yield pick up against Asian LCY government bonds and credits.

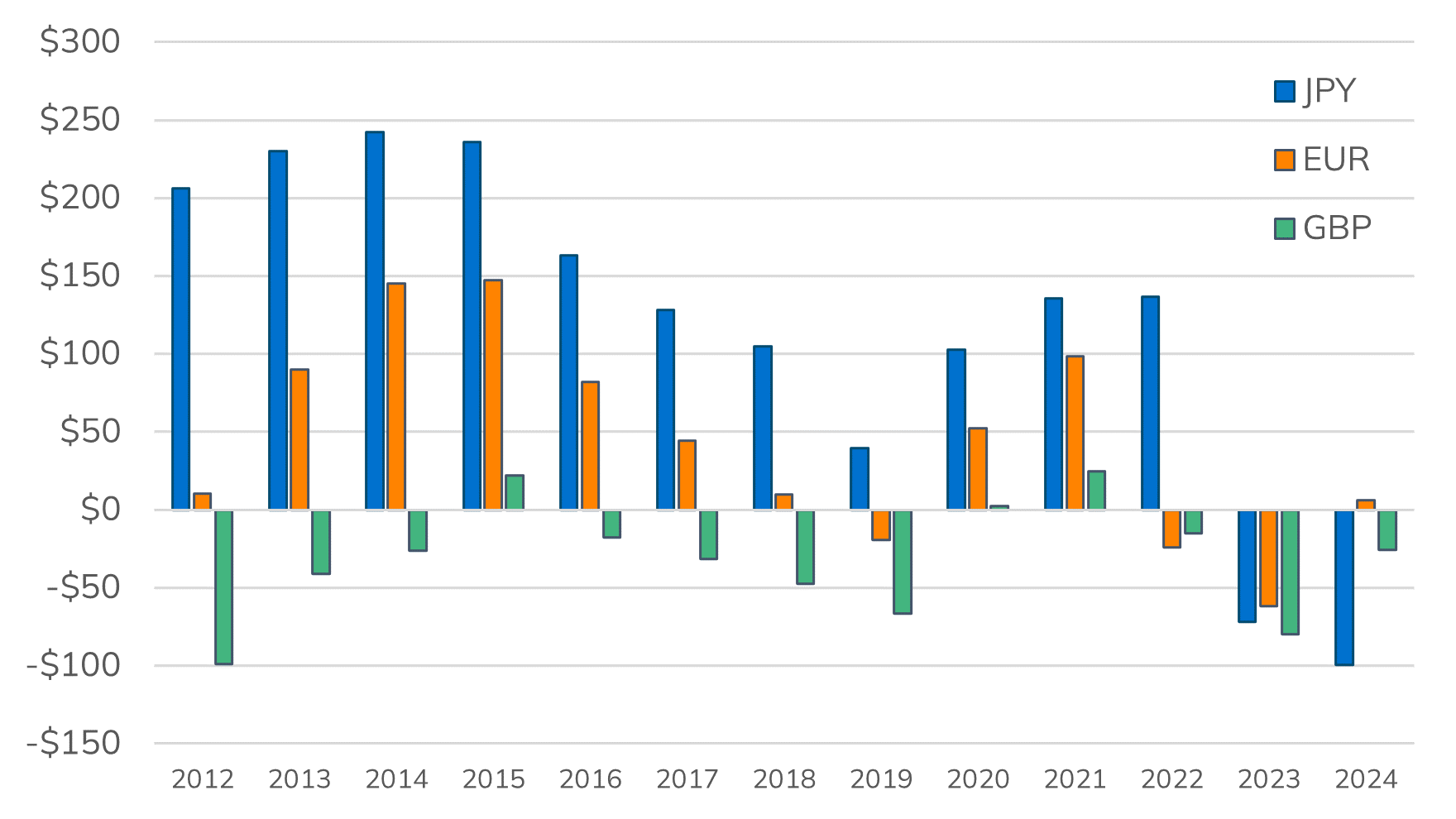

The authors suggest an FX hedged yield pick up of at least 50bp as the baseline yield bogey for determining attractive relative value opportunities after considering transaction costs and liquidity differences etc. The chart below shows the estimated yield pick up of holding US IG versus local currency IG (annual averages 2012-2024).

Source: CreditSights, US Department of the Treasury

Beyond relative value

For investors assessing markets outside of their home currencies, other considerations might include:

- Liquidity (size, scale and depth of market): Larger markets with more liquidity can help keep transaction costs lower.

- New issue supply: The US IG market is the largest and most active primary market.

- Legal framework and bondholder protections: These differ across geographies, with developed markets generally having more robust protections in place.

- Geographic/ sector diversification: Where portfolios have a handful of large, recurring issuers this can account for an outsized portion of exposure. With most portfolios having limits on single name exposure, investors may need to look to other markets to diversify the concentration. However, many of the largest issuers take advantage of liquidity across geographies by issuing across currencies. This means investors can gain exposure to issuers outside their home country without taking FX risk.

- Duration requirements: Availability of bonds with 10+ year tenors are key considerations for fixed income investors requiring longer-dated liabilities.

Future events

Hybrid

Hybrid CreditSights New to Credit: Summer Learning Programme

16 June 2025

to

Webinar

Webinar

Mastering Private Credit: Essential Skills for Success

08 July 2025

2:30 pm to 3:15 pm BST

Info Session

Info Session Info Session: Accelerate your career with the Global Credit Certificate

15 July 2025

9:30 am to 10:00 am BST

2:00 pm to 2:30 pm EDT